Would They Do It Again? A Deep Dive Into Regret, Debt, and the Value of College

Grads weigh in on costs, outcomes, and whether they'd take the same path again.

You hear it all the time: a college degree is supposed to pay off. But for many graduates, the reality is a mix of financial strain, delayed milestones, and career paths that look nothing like what they expected. We surveyed 1,011 U.S. college graduates to understand how they experienced debt, job outcomes, and the long-term value of their education. Their answers offer a grounded look at what typical degree programs actually deliver and where they fall short.

Key Takeaways

- College grads overestimated their starting salaries by an average of 32%.

- Half say their degree made them financially better off, but 1 in 3 say it didn't.

- On average, graduates report needing 10 to 12 years to pay off their student loans.

- 29% of graduates say their job is not closely tied to their field of study.

- If they could start over, 46% of graduates would still go to college but choose a different major or school, while 33% would take the exact same path.

- Most men and women pursued additional training after college, with women favoring formal certifications (44%) and men leaning toward self-taught learning (44%).

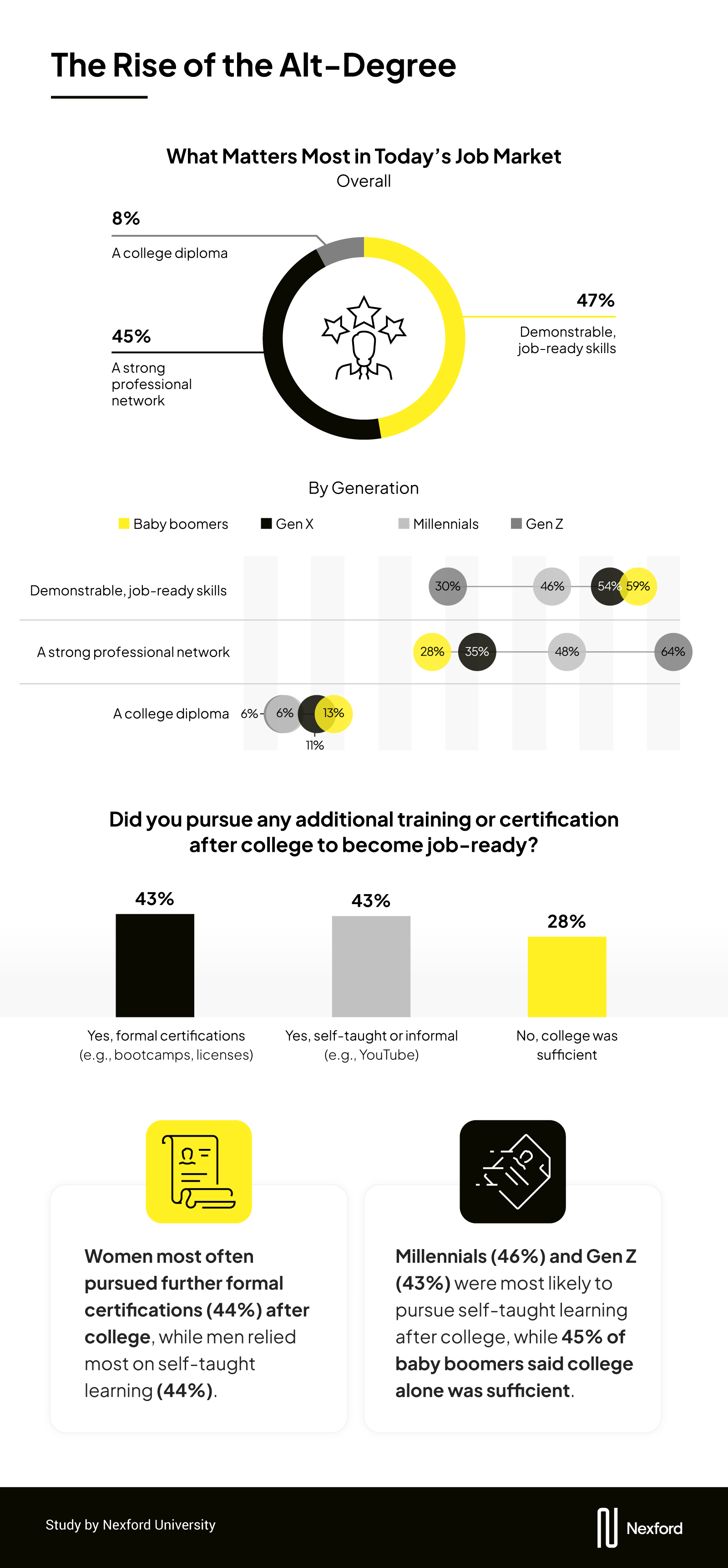

- 47% of all respondents chose job-ready skills as the top factor in today's job market.

A National Check-In on Whether College Was Worth It, Considering the Money, the Time, and the Tradeoffs

Some students can feel the weight of college debt long after graduation. For many people, financial tradeoffs affected both their early career and their personal milestones.

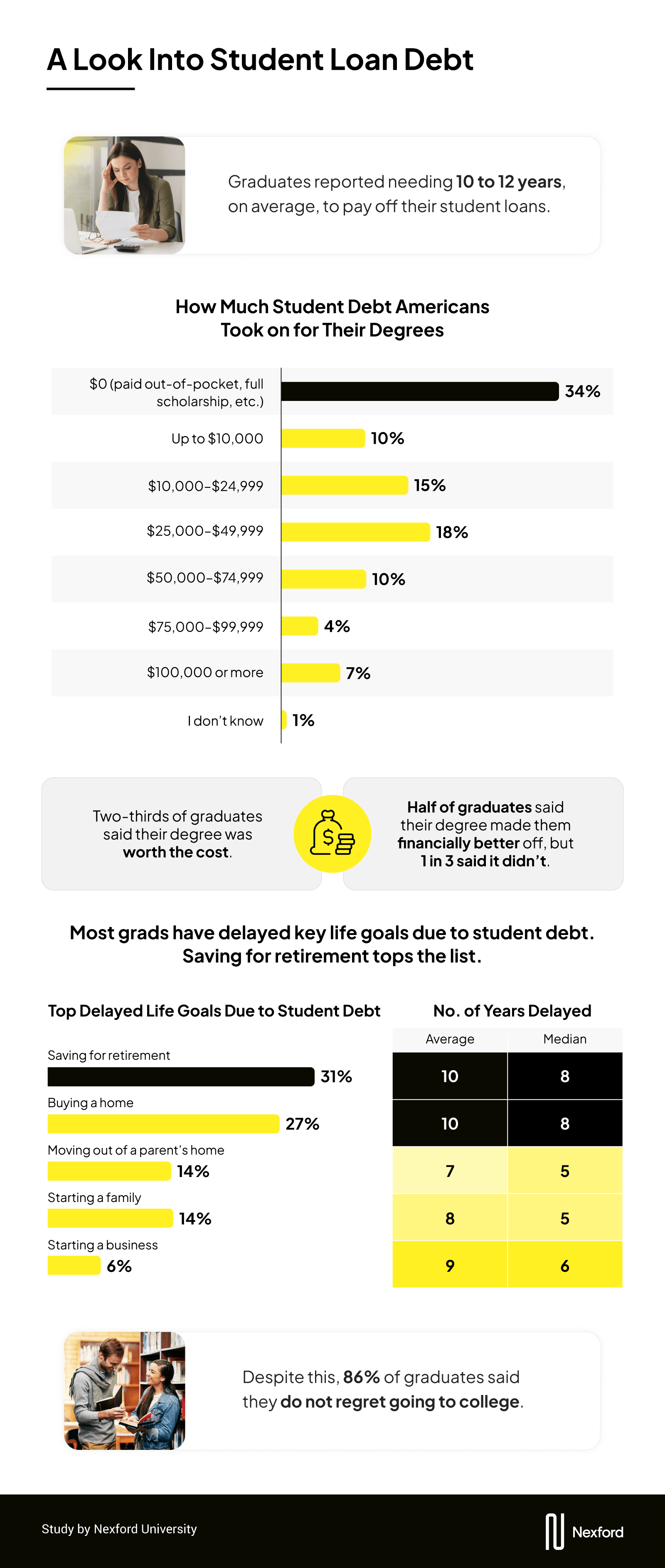

The most common debt range among borrowers was $25,000 to $49,999, reported by 18% of respondents. Another 25% had less than $25,000 in debt, and 21% graduated with over $50,000 owed. Just over a third (34%) avoided student debt entirely by paying out of pocket or receiving full scholarships. Graduates who borrowed said they needed 10 to 12 years on average to pay off their loans.

When asked whether it was worth the cost, 2 in 3 college grads said yes. Half felt financially better off because of their degree. But 1 in 3 said it did not improve their financial situation, and many have had to put off life goals. Retirement planning took a hit for many grads, as 31% said student debt delayed their ability to start saving for life after work.

Buying a home was the second most delayed milestone, pushed back by 27% of graduates for an average of 10 years. The good news is that most people (86%) don't regret going to college. Although it may have been costly and things may not have turned out as planned, they still found value in the experience.

Let's now take a look at what people would do if they could go back in time, knowing what they now know.

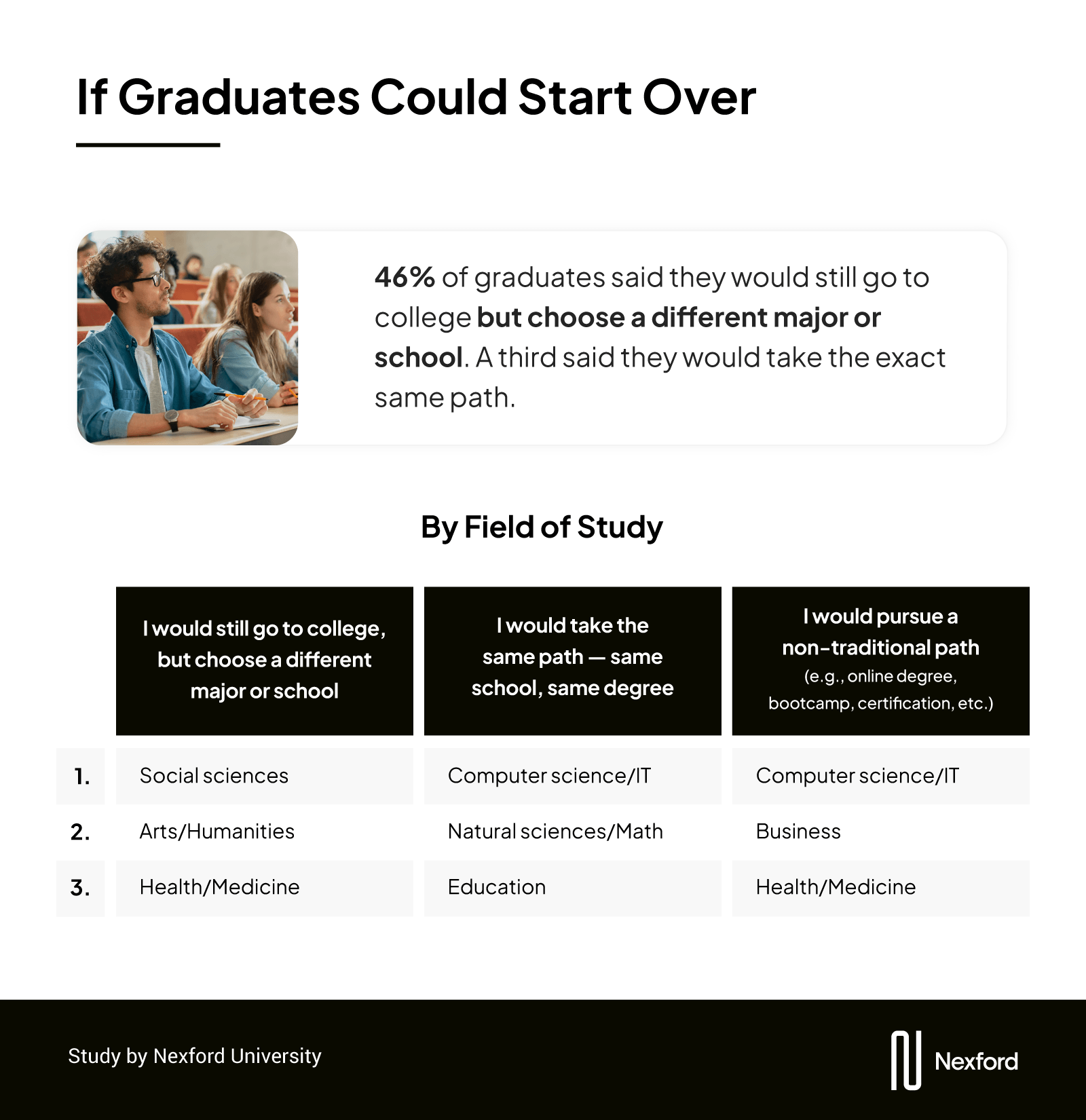

Nearly half of college grads (46%) said they would choose a different path if they could start over — still going to college, but picking a different major or school. Others said they would pursue a non-traditional path, such as an online degree or certification instead. Those most likely to say so had studied computer science/IT, business, or health/medicine at a traditional college. A third of grads said they would follow the exact same path as before.

Is the Modern College Degree Still Delivering the Job Market Advantage It Promises?

Graduates expected a direct connection between their degree and their career path. What they found instead was a job market that rewards adaptability more than a perfect match between a major and a career.

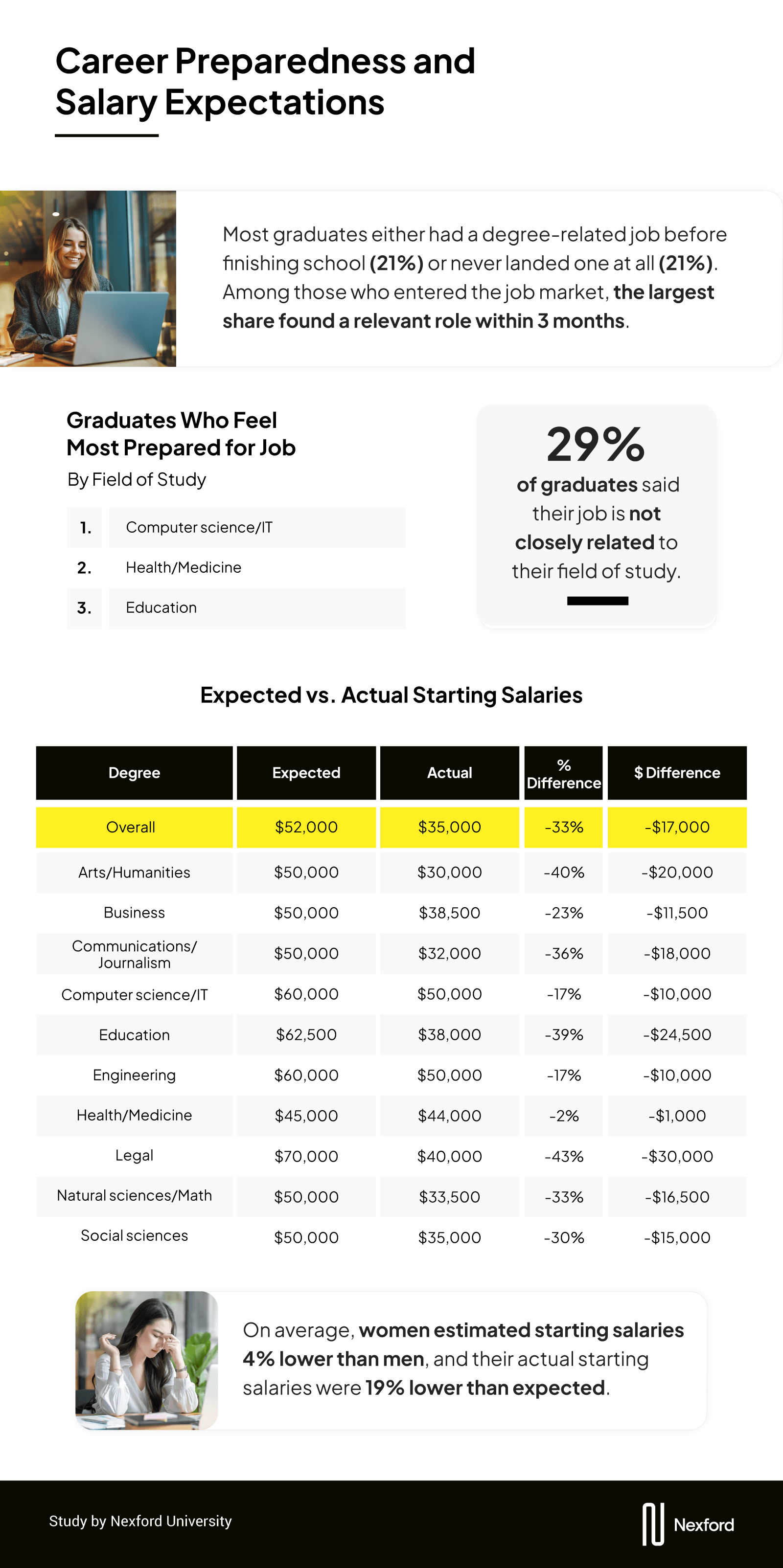

By graduation, most students realized the transition into the workforce wasn't as seamless as they had hoped. Only 38% felt fully prepared to start their careers. About 1 in 5 had a job in their field lined up before finishing school, while another 1 in 5 never landed a degree-related role at all. For those who did, most found one within roughly 3 months. A lot of graduates also said the job they have now doesn't really match what they studied. Twenty-nine percent said their current work isn't closely related to their major, and 23% said it only somewhat is.

Salary expectations were off, too. On average, graduates overestimated their starting pay by 32%. Business and engineering majors were the most accurate, missing the mark by just 3%. A gender gap showed up as well. Women expected slightly lower starting salaries than men did, at about 4% less. Their actual starting pay ended up being 19% lower than what they thought it would be.

A Shift in Sentiment: Would Today's Grads Choose Something Different?

Expectations have changed. Many graduates are looking for skills, speed, and real career relevance rather than a traditional one-path-fits-all degree.

When people were asked what matters most in today's job market, almost half (47%) pointed to job-ready skills. Networking was close behind at 45%, and only 8% said a typical college degree carries the most weight. Younger workers leaned more toward the power of connections, with 64% of Gen Z and 48% of millennials choosing networking. Gen X and baby boomers were more likely to prioritize hands-on, job-ready skills, at 54% and 30%, respectively.

For many, learning did not stop at graduation. Both men and women pursued extra training, but in different ways. Women tended to choose formal certifications (44%), while men were more likely to teach themselves (44%). Millennials (46%) and Gen Z (43%) were the most likely to take on self-taught learning after college, while 45% of baby boomers felt that a college degree alone was enough.

Choosing a Path That Works for You

The conversation around the value of college is changing. People are proud of earning their degrees, yet many needed more practical skills and more support once they reached the workforce. This is your opportunity to take a smarter approach. Focus on programs that put skill-building first, offer true flexibility, and meet the demands of today's employers. The right education should help you grow without slowing you down.

Methodology

We surveyed 1,011 American adults with college degrees to understand how they value their college degrees compared to the financial, professional, and personal outcomes they experienced after graduation. The study examined student debt, repayment timelines, career alignment, salary expectations versus reality, additional training needs, and how graduates assess the overall return on their education.

The sample consisted of 57% women, 41% men, and 2% non-binary individuals. Due to the small sample size, nonbinary respondents were excluded from gender-specific breakdowns. By generation, fewer than 1% of respondents belonged to the Silent Generation, 7% were baby boomers, 27% were Gen X, 54% were millennials, and 12% were Gen Z. Silent Generation respondents were excluded from the generational breakdowns due to their low representation.

The data was collected in November 2025.

About Nexford University

Nexford University is a modern online university built to get you career-ready fast. Our affordable, flexible degrees, like our accelerated bachelor's programs and online AI degree, are designed around real employer needs. That means you'll build practical, in-demand skills you can use right away. Learn on your schedule, from anywhere in the world, with 24/7 support when you need it. If you're aiming for a future-proof and debt-free career, Nexford gives you the edge.

Fair Use Statement

The information in this article may be used for noncommercial purposes only. If shared, proper attribution with a link back to Nexford University must be provided.