Online MBA in Finance

Jan. 1, 2027

Lead where finance meets innovation

Lead where finance meets innovation

Finance is evolving faster than ever. Global volatility, technological disruption, and rising expectations from stakeholders are reshaping how capital is raised, allocated, and managed. Leaders who can connect strategy, technology, and innovation aren’t just valuable – they’re essential.

The Nexford MBA in Finance equips professionals – including analysts, consultants, and managers – with advanced expertise in financial strategy, investment management, and emerging technologies such as AI and blockchain, preparing them to lead at the highest level.

This 100% online program prepares you for leadership roles such as Financial Manager, Portfolio Manager, Chief Financial Officer, and Investment Strategist. While enrolled in the MBAF you will get access to the full suite of seven certificates from global leader CFI™, at no additional cost.

Skills you will learn - and add to your résumé

Design portfolio strategies across asset classes, integrating ESG factors and alternative investments.

Identify, assess, and mitigate credit, market, liquidity, and operational risks using proven methods.

Design portfolio strategies across asset classes, integrating ESG factors and alternative investments.

Identify, assess, and mitigate credit, market, liquidity, and operational risks using proven methods.

Future-focused yet affordable

With our pay-as-you-go model if you finish faster, you'll pay less.

- Affordable monthly payments

- Pause or cancel anytime

- No fixed long-term contracts

- No hidden fees - ever

Courses in the MBA in Finance

This course provides a comprehensive exploration of the rapidly evolving landscape of financial technology (Fintech) and its transformative impact on the financial services industry. Learners will delve into the core technologies driving Fintech innovation, including artificial intelligence (AI), machine learning (ML), distributed ledger technology (DLT), cryptography, digital identity solutions, SaaS platforms, chatbots, robotic process automation (RPA), and augmented reality (AR). The course examines how these technologies are reshaping traditional financial services verticals such as payments, deposits and retail banking, lending, capital raising, wealth management, insurance, financial infrastructure, and regulation. Learners will analyze real-world case studies, evaluate emerging business models, and assess the challenges and opportunities presented by Fintech disruption. The course emphasizes the strategic implications of Fintech for both established financial institutions and disruptive startups, preparing learners to lead and innovate in the finance of tomorrow.

This course provides a comprehensive understanding of the interplay between macroeconomic forces and financial markets. Students will learn how to apply economic theory to analyze the functioning of financial markets, assess the impact of government policies, and understand key macroeconomic indicators. The course delves into the determinants of national income, employment, investment, interest rates, money supply, inflation, and exchange rates.

This course provides a comprehensive understanding of Environmental, Social, and Governance (ESG) factors and their growing importance in the financial industry. You will analyze corporate sustainability reports, identify material ESG issues relevant to different industries, evaluate the methodologies used by ESG rating agencies, and integrate ESG considerations into traditional financial analysis and valuation. The course will equip you with the skills to make informed ESG-integrated investment decisions and understand the evolving landscape of sustainable finance.

This course provides a comprehensive exploration of the rapidly evolving landscape of financial technology (Fintech) and its transformative impact on the financial services industry. Learners will delve into the core technologies driving Fintech innovation, including artificial intelligence (AI), machine learning (ML), distributed ledger technology (DLT), cryptography, digital identity solutions, SaaS platforms, chatbots, robotic process automation (RPA), and augmented reality (AR). The course examines how these technologies are reshaping traditional financial services verticals such as payments, deposits and retail banking, lending, capital raising, wealth management, insurance, financial infrastructure, and regulation. Learners will analyze real-world case studies, evaluate emerging business models, and assess the challenges and opportunities presented by Fintech disruption. The course emphasizes the strategic implications of Fintech for both established financial institutions and disruptive startups, preparing learners to lead and innovate in the finance of tomorrow.

This course provides a comprehensive understanding of the interplay between macroeconomic forces and financial markets. Students will learn how to apply economic theory to analyze the functioning of financial markets, assess the impact of government policies, and understand key macroeconomic indicators. The course delves into the determinants of national income, employment, investment, interest rates, money supply, inflation, and exchange rates.

This course provides a comprehensive understanding of Environmental, Social, and Governance (ESG) factors and their growing importance in the financial industry. You will analyze corporate sustainability reports, identify material ESG issues relevant to different industries, evaluate the methodologies used by ESG rating agencies, and integrate ESG considerations into traditional financial analysis and valuation. The course will equip you with the skills to make informed ESG-integrated investment decisions and understand the evolving landscape of sustainable finance.

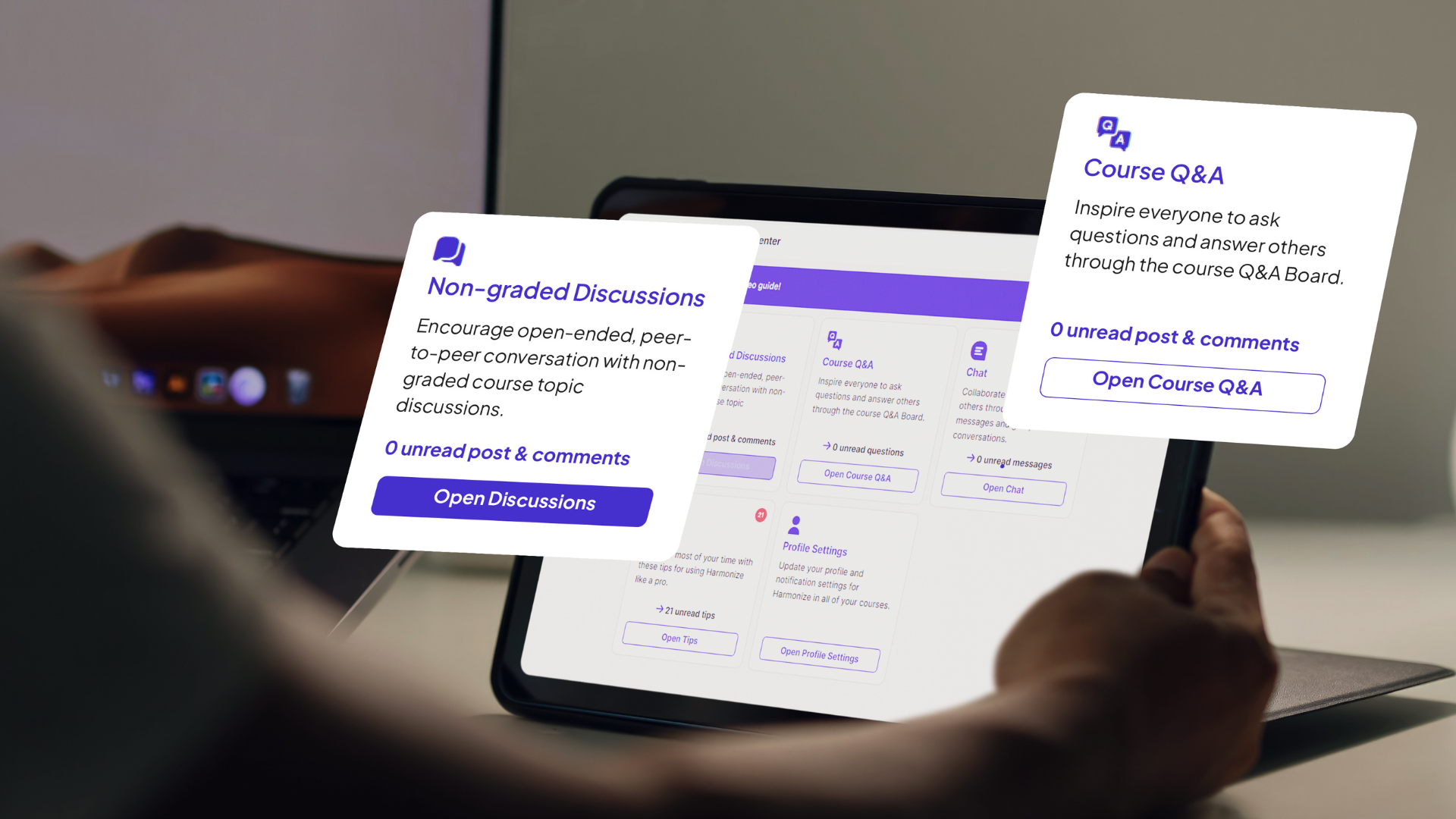

What’s it like to learn at Nexford?

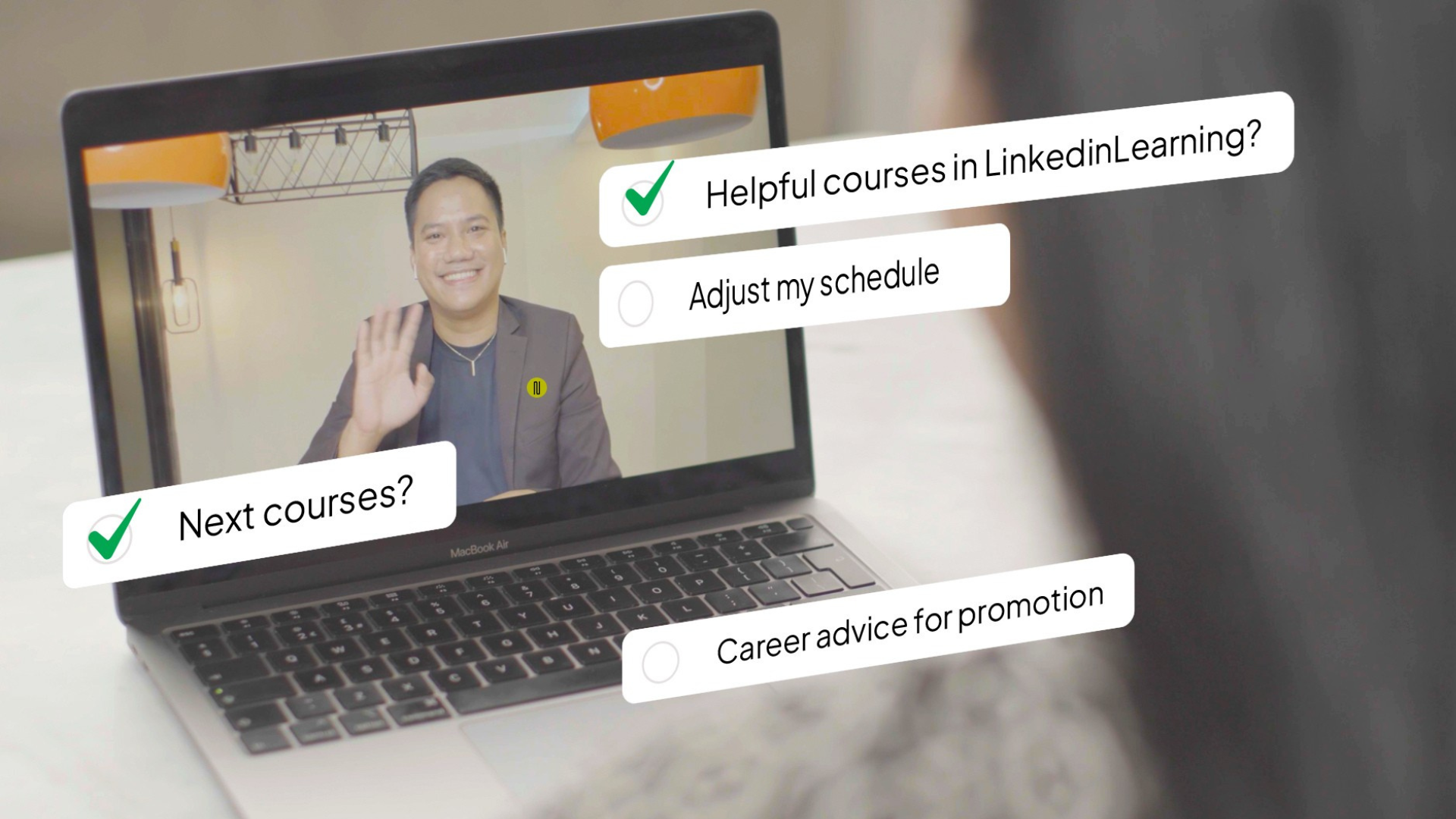

Upon completing your first three MBAF courses, and for the remainder of enrollment duration: you will gain access the full suite of 250 CFI courses, the full suite of 7 CFI certifications, 550+ Verifiable CPD credits from CFI, monthly live office hours with CFI financial experts and job-ready templates and guides such as financial models. All at no additional cost. Learn more about CFI certificates here.

Build skills by doing. Every course includes hands-on projects that mirror real workplace challenges like building financial models plans, data dashboards, or marketing strategies. You won’t just learn about it - you’ll practice doing it. And projects are often curated from the world's largest organizations.

MBA in Finance Admission requirements

Where our learners work

Join us for a free virtual tour

Join us live to see how learning at Nexford works, hear from alumni, and get your questions answered by current learners, faculty, and staff.

Your dedicated career success platform

Your dedicated career success platform

Finish faster with Nexford's 10 month MBAF

Earn your MBAF in just 10 months by completing courses faster and increasing your course load. Your progress is based on mastering skills – not spending time in class – because that’s what employers actually value. You can also graduate faster by transferring credits from prior education or even relevant work experience.

- Course load: 1 course

- Pace: 1 course per month

- Course load: 2 courses

- Pace: 2 courses per month

- Course load: 1 capstone course

- Pace: 1 course over two months

Others block AI. We expect you to master it.

Real projects you'll complete in your MBAF

Build a professional fundraising presentation using valuation models, cap tables, and fund allocation plans for a high-growth company.

Build a professional fundraising presentation using valuation models, cap tables, and fund allocation plans for a high-growth company.

MBA in Finance career outlook

- Chief Financial Officer (CFO)

- Finance Business Partner

- Financial Manager

- Portfolio Manager

- Investment Strategist

- Wealth Manager

- Quant Analyst

- Blockchain Consultant

- Fintech Specialist

- Financial Consultant

- Risk Advisory Manager

- Strategy Consultant

Hear from our alumni and their employers

Thank you so much for the opportunity to be part of Nexford University. My education there significantly helped me advance my career. Additionally, my MBA has been successfully recognized as equivalent in my home country, Indonesia.

As a current MBA student at Nexford University, i like the flexile modality of study especially for full time employees, also the project-based learning approach with updated syllabuses, real case studies with top tech companies like Amazon, Tesla , Toyota, Apple...etc. and affordable at the same time for low middle income countries students.

Meet your future faculty

Meet your future faculty

Learn from faculty who are also experienced business leaders, entrepreneurs, and subject-matter experts. Their real-world experience helps ensure what you’re learning is practical, career-relevant, and aligned with what employers actually need. Join live group sessions or book 1:1 time when you need support.

Nexford is accredited.

Nexford University is accredited by the Distance Education Accrediting Commission (DEAC).

The DEAC is listed by the U.S. Department of Education as a recognized accrediting agency and is recognized by the Council for Higher Education Accreditation (CHEA).

Nexford University is accredited by the Distance Education Accrediting Commission (DEAC).

The DEAC is listed by the U.S. Department of Education as a recognized accrediting agency and is recognized by the Council for Higher Education Accreditation (CHEA).