.png)

Start your degree with a single course

Skills that count now - and toward your degree

Every Nexford course is designed to deliver more than academic credit – it delivers practical skills you can put to work right away. From business to technology, each course is built with real-world application in mind, helping you grow your career from day one. And because every course also carries degree credit, you’ll keep your options open: whether you stop at one course or continue all the way to a full degree, nothing you learn goes to waste.

You will receive a certificate for every course you complete successfully.

Why start with an individual course?

Available courses

Clear filters

Financial Accounting

Course description:

What you will learn:

Record business transactions accurately using the double-entry system.

Build and analyze financial statements to assess a company's health.

Apply international accounting standards (IFRS) for accurate reporting.

Use key financial ratios to gain insight into a company's profitability.

Course counts towards:

- Associate of Applied Science (AAS)

- BBA with specialization in Entrepreneurship

- Bachelor of Business Administration (BBA)

Managerial Accounting and Cost Analysis

Course description:

What you will learn:

Create budgets and forecasts to guide business planning and manage resources.

Analyze business costs to make smart decisions on pricing and production.

Compare planned budgets with actual results to improve performance.

Use cost data to support internal strategy and make better business decisions.

Course counts towards:

- BBA with specialization in Entrepreneurship

- Career Pathway in Professional Sales

- Bachelor of Business Administration (BBA)

Auditing and Assurance Services

Course description:

What you will learn:

Plan and conduct financial statement audits using international standards.

Assess and respond to business risks - including fraud - by testing internal controls.

Analyze audit evidence to form a professional opinion on financial accuracy.

Write and present formal auditor reports to communicate findings to stakeholders.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Accounting and Financial Reporting

Course description:

What you will learn:

Assess an organization's financial performance and the quality of its reports.

Apply analytical tools to financial data to uncover trends and insights.

Consolidate financial transactions to build accurate statements and reports.

Analyze how different accounting treatments affect financial statements.

Course counts towards:

- Master of Business Administration (MBA)

- MS in Data Analytics (MSDA)

- MBA in Entrepreneurship (MBAE)

- Mini MBA Certificate

Introduction to AI

Course description:

What you will learn:

Apply AI to solve real-world challenges in industries like healthcare and finance.

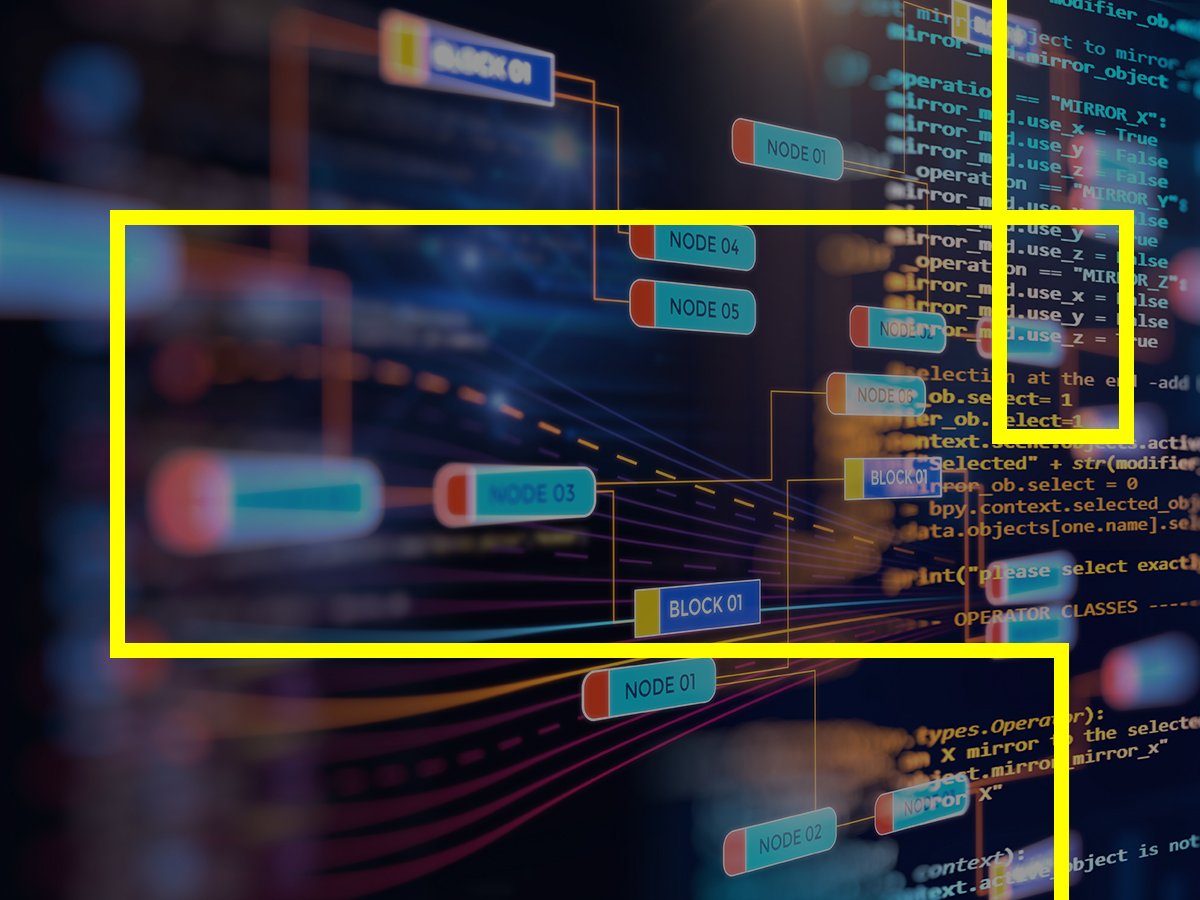

Use AI techniques like machine learning and NLP to analyze complex problems.

Develop AI-driven strategies to optimize business processes and create an advantage.

Evaluate the ethical implications of AI to ensure responsible implementation.,

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

- Career Pathway in Operations Management

- Career Pathway in Professional Sales

- BBA with specialization in AI

- BBA with specialization in Business Analytics

Foundations of Robotics and IoT

Course description:

What you will learn:

Analyze modern cybersecurity models covering people as well as policy and technology.

Evaluate how legal and regulatory policies impact data security requirements.

Analyze network and data architectures to identify security threats.

Implement layered technical defense strategies using modern security tools.

Course counts towards:

- BBA with specialization in AI

- Bachelor of Business Administration (BBA)

Fundamentals of Cybersecurity

Course description:

What you will learn:

Analyze the evolution of cybersecurity from the information security models of 1991 to the modern dynamic and holistic models.

Evaluate how the legal policy and regulatory landscape impacts organizational data classification and risks as well as access control and other cybersecurity requirements.

Analyze typical organizational information network and data storage as well as transmission and processing architectures both on premises and in the cloud including various technology and policy and people threats from both inside and outside the organization. Examine layered technical defense strategies and various technology tools and controls.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in AI

Data Sciences for Decision Making

Course description:

What you will learn:

Build a strong business case for investing in AI technology.

Develop a financial model to assess the costs and benefits of AI projects.

Use different valuation methods to quantify the financial impact of AI.

Communicate the value of AI to senior leaders to secure project funding.

Course counts towards:

- MBA with specialization in AI

- MS in Data Analytics (MSDA)

- MS in Digital Transformation (MSDT)

- Master of Business Administration (MBA)

- MS in AI and Technology Management (MSAI)

Artificial Intelligence

Course description:

What you will learn:

Evaluate AI-related risks.

Develop a risk management framework to identify and assess as well as mitigate AI risks.

Implement controls and safeguards to ensure the responsible and ethical use of AI.

Monitor and report on AI risks to leadership and key stakeholders.

Course counts towards:

- MBA with specialization in AI

- MS in Data Analytics (MSDA)

- Master of Business Administration (MBA)

Robotics and Automation

Course description:

What you will learn:

Apply design thinking to identify opportunities for human-centered AI solutions.

Lead an AI project from idea to deployment as well as managing scope and resources.

Build and manage a cross-functional team of AI and business experts.

Navigate the common challenges of AI implementation like data quality and change management.

Course counts towards:

- MS in Digital Transformation (MSDT)

- Master of Business Administration (MBA)

- MS in AI and Technology Management (MSAI)

Data Analytics

Course description:

What you will learn:

Use data analytics to solve business problems and drive strategic decisions.

Apply statistical methods to analyze data and uncover meaningful insights.

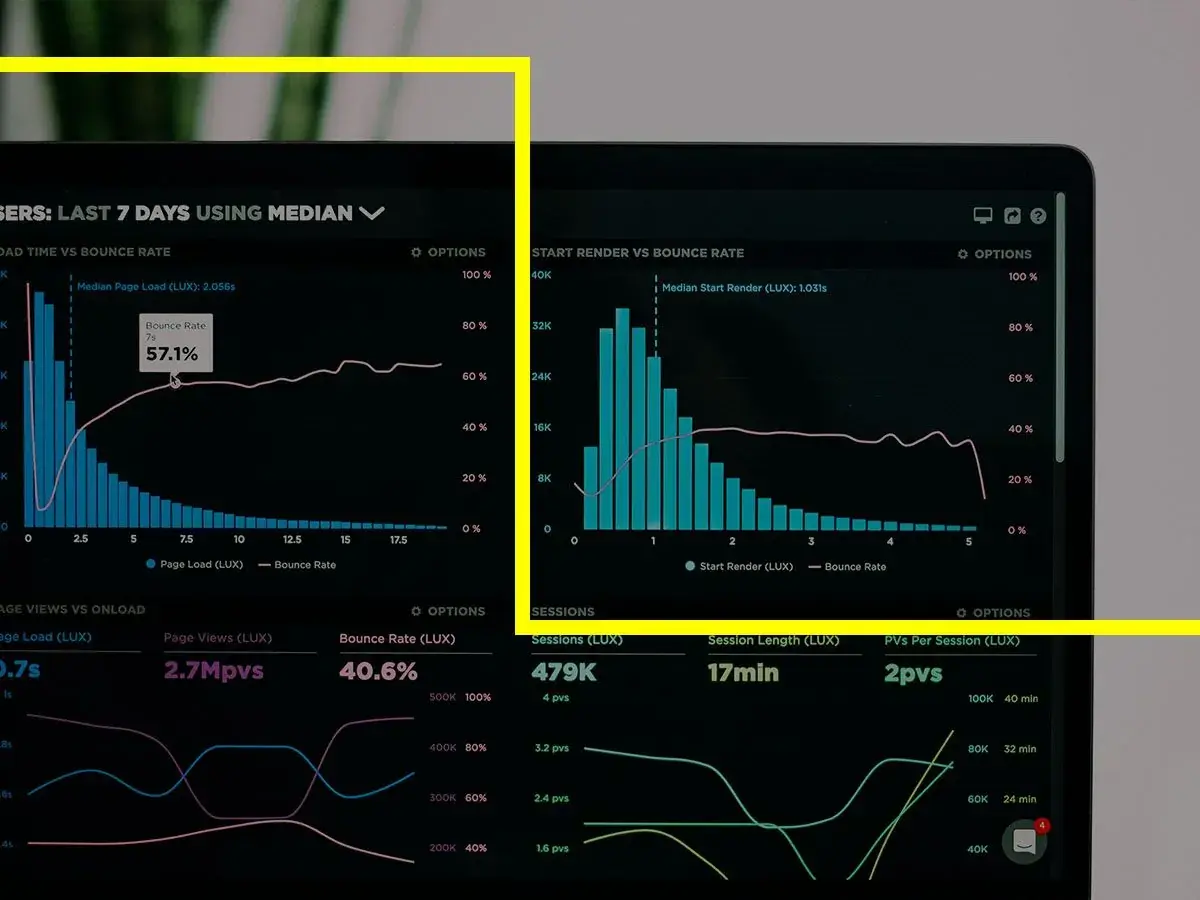

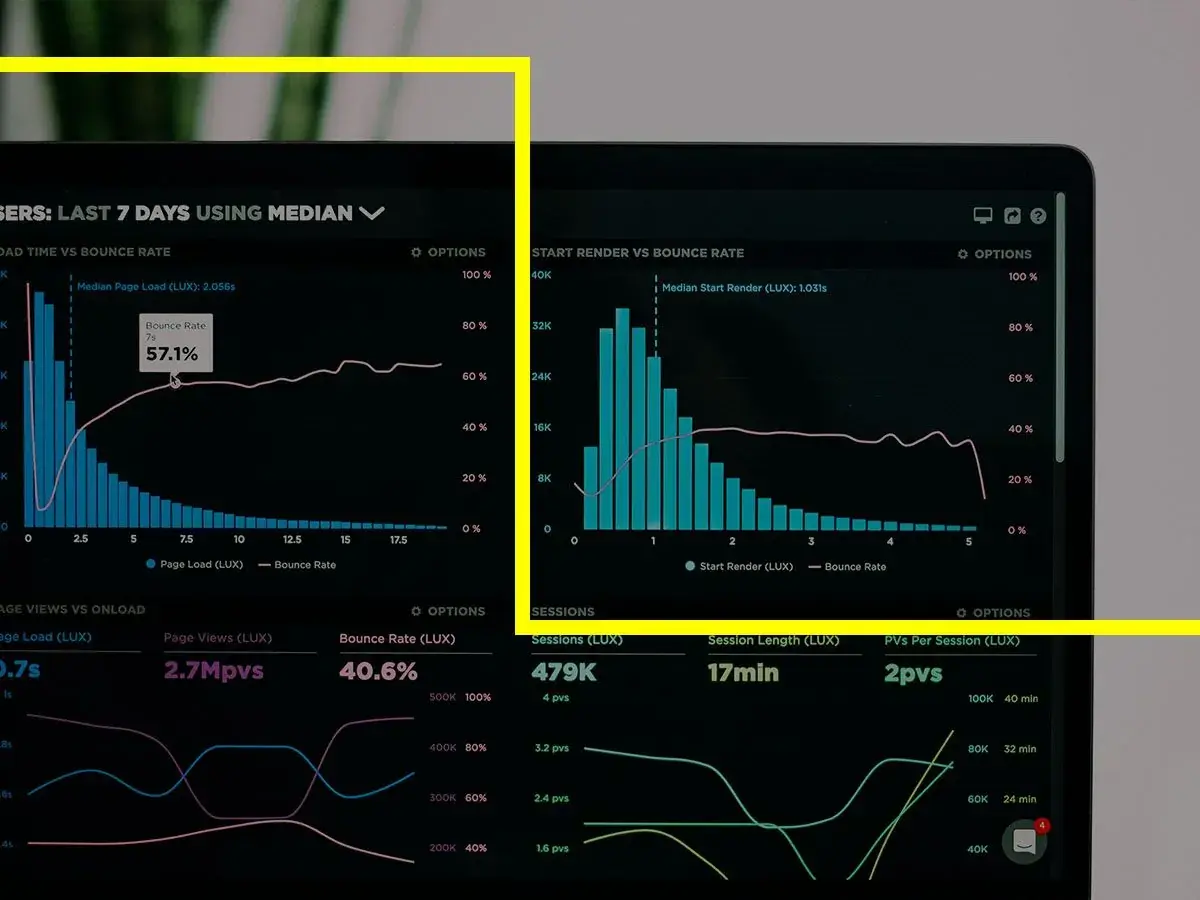

Create compelling charts and dashboards to communicate data findings effectively.

Navigate the ethical considerations of data collection and analysis.

Course counts towards:

- Associate of Applied Science (AAS)

- Career Pathway in Operations Management

- Career Pathway in Professional Sales

- Bachelor of Business Administration (BBA)

Machine Learning and Predictive Analytics

Course description:

What you will learn:

Use storytelling techniques to communicate data insights in a clear way.

Use data visualization tools to create compelling data stories.

Tailor your data stories to different audiences for maximum impact.

Measure the impact and effectiveness of your data stories.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in AI

- BBA with specialization in Business Analytics

Data Analysis and Visualization

Course description:

What you will learn:

Use business intelligence (BI) to make informed business decisions.

Use BI tools to collect as well as analyze and visualize data.

Build and manage BI dashboards and reports for stakeholders.

Communicate BI insights clearly to decision-makers.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Business Analytics

Business Analytics

Course description:

What you will learn:

Analyze the relationship between business strategy as well as data and knowledge.

Apply data mining methods to solve real-world business problems.

Build and evaluate models that turn raw data into actionable insights.

Present the results of your data analysis to different audiences.

Course counts towards:

- MS in Data Analytics (MSDA)

Programming in R & Python

Course description:

What you will learn:

Use predictive analytics to forecast future trends and events.

Build and evaluate predictive models for accuracy and performance.

Apply predictive analytics to solve problems like customer churn.

Communicate the results of predictive analytics to stakeholders.

Course counts towards:

- MS in Data Analytics (MSDA)

Data Modeling and Mining

Course description:

What you will learn:

Develop a data governance framework to ensure data quality and security.

Implement data governance policies and procedures across an organization.

Monitor and audit data governance processes to ensure compliance.

Communicate the importance of data governance to stakeholders.

Course counts towards:

- MS in Data Analytics (MSDA)

Applied Machine Learning for Business Analytics

Course description:

What you will learn:

Develop and manage a data warehouse to support business analytics.

Design and implement ETL processes to integrate data from different sources.

Use SQL to query and analyze the data stored in a data warehouse.

Build data models and reports to support better business decisions.

Course counts towards:

- MS in Data Analytics (MSDA)

- MS in AI and Technology Management (MSAI)

Information Visualization & Communication

Course description:

What you will learn:

Master how to explain the importance of data visualization for professionals working with data.

Master how to describe the process of designing and implementing interactive visualizations for data discovery and analysis and presentation.

Master how to utilize case studies and workplace resources to demonstrate effective data visualization and communication.

Master how to assess the strengths and weaknesses of different visual encoding methods and their impact on human perception.

Course counts towards:

- MS in Data Analytics (MSDA)

- MS in AI and Technology Management (MSAI)

Roadmap to Success

Course description:

What you will learn:

Demonstrate the use of MS Office software to create documents as well as spreadsheets and presentations for the business environment.

Identify reliable sources for research as well as synthesize information and cite sources.

Define the basic fundamentals of business. Master how to list your personal strengths and attributes and how they would transfer into your professional leadership/management style.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

- Career Pathway in Operations Management

- Career Pathway in Professional Sales

International Business and Culture

Course description:

What you will learn:

Describe the business environment within the context of globalization.

Master how to examine how organizations operate from an international business perspective.

Master how to interpret the connection between an organization that operates in both global and domestic environments regarding culture and organizational structure.

Master how to identify the connections between international business and culture.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

The World of Business

Course description:

What you will learn:

Describe the role of business in society as well as the core functions within a business and internal and external forces that affect business activities and productivity.

Define ethics and integrity and social responsibility in the context of business.

Master how to identify the advantages and disadvantages of different forms of business and organizational structure.

Master how to assess the functions and interconnectivity that each functional area performs to meet business objectives in small and medium and multinational enterprises including the large number of small-medium enterprises in emerging economies.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

- Career Pathway in Operations Management

Introduction to Business Law

Course description:

What you will learn:

Describe sources of international law that affect global business transactions and the most common forms of international business operations.

Master how to apply the legal environment to domestic and international business scenarios.

Master how to identify the importance of integrating legal and ethical practices to create effective business practices and procedures.

Master how to explain the importance of the legal environment in domestic and international business applications.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

Business and Culture in China

Course description:

What you will learn:

Describe the business environment in China including its traditions and society.

Master how to apply knowledge of the complexities of contrasting cultures to navigate complex business challenges across national borders.

Master how to identify the micro and macro forces shaping international business between China and other countries both in supporting and resisting globalization.

Master how to analyze current conditions in China and evaluate present and future opportunities and risks for international business activities.

Course counts towards:

- Bachelor of Business Administration (BBA)

Business and Culture in Sub-Saharan Africa

Course description:

What you will learn:

Describe the business environment within Sub-Saharan Africa including its traditions and systems and society.

Identify the micro and macro forces shaping international business between Sub-Saharan Africa and other regions both in supporting and resisting globalization.

Explain how businesses operate in Sub-Saharan Africa from a stakeholder's perspective of market/non-market and internal/external perspectives.

Analyze current conditions in Sub-Saharan Africa for their influence on present and future business opportunities and risks for international business activities.

Business and Culture in India

Course description:

What you will learn:

Key concepts and apply them to practical industry scenarios.

Develop strategic solutions to common business challenges.

Enhance your professional skills in this subject area.

Communicate your findings effectively to stakeholders.

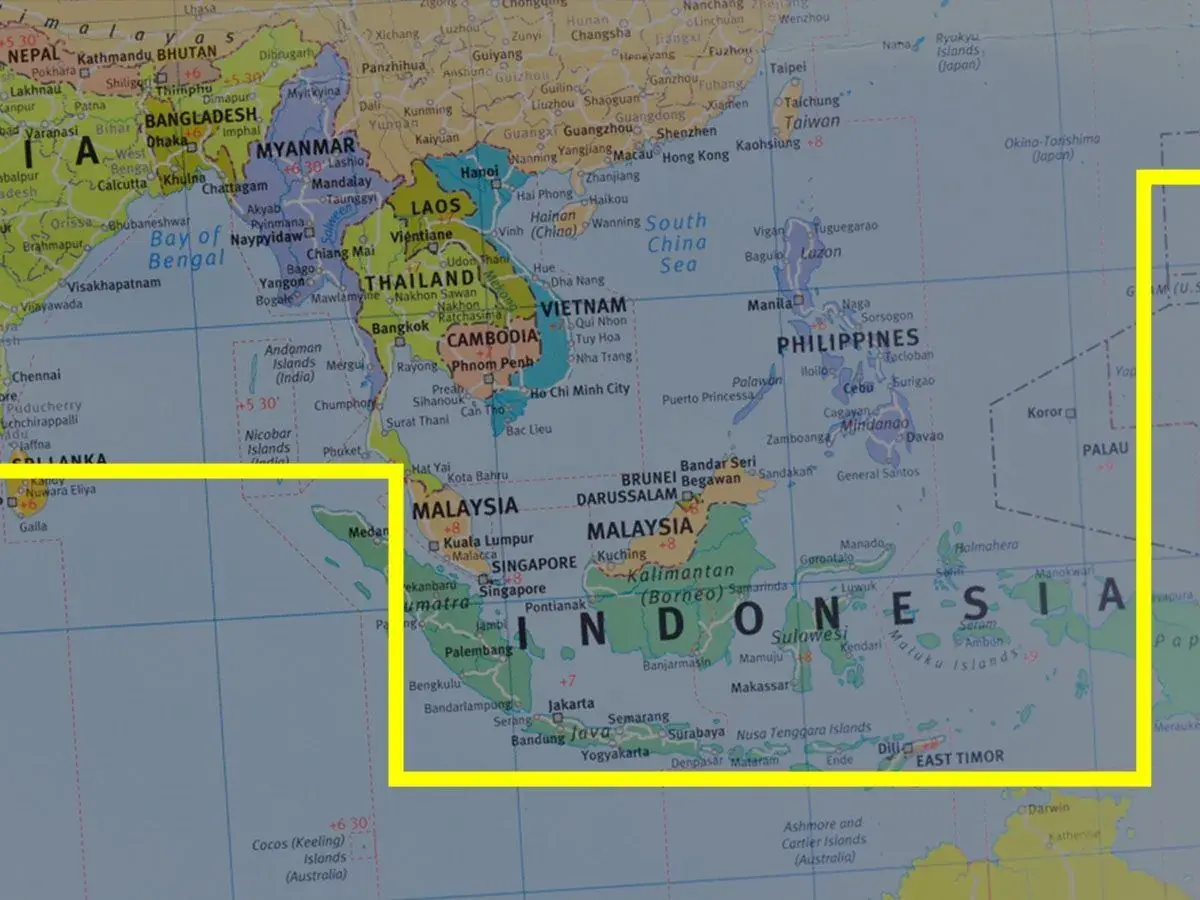

Business and Culture in Southeast Asia

Course description:

What you will learn:

Describe the business environment within Southeast Asia including its traditions and systems and society.

Master how to identify the micro and macro forces shaping international business between Southeast Asia and other countries both in supporting and resisting globalization.

Master how to explain how businesses operate in Southeast Asia from a stakeholders' perspective of market/non-market and internal/external perspectives.

Master how to analyze current conditions in Southeast Asia for their influence on present and future business opportunities and risks for international business activities.

Principles of Management

Course description:

What you will learn:

Develop a personal philosophy of leadership management and membership in the global workplace through a personal inventory and assessment

Master how to evaluate the importance of team dynamics on organizational effectiveness asn well as productivity and communication within an organization.

Master how to develop a leadership plan to manage remote teams.

Master how to identify the stages of team development and the role of the leader and the follower.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

- Career Pathway in Operations Management

Business Career Branding for Success

Course description:

What you will learn:

Analyze competitive strengths and gaps using core business tools.

Master how to translate NXU academic and business as well as co-curricular experiences into high-demand marketable and transferable skills needed for career or academic planning.

Master how to integrate information and services from a variety of human and print as well as electronic resources to develop and maintain academic and career plans.

Master how to create a plan to enhance the performance of an existing business.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Organizational Relationships

Course description:

What you will learn:

Define the interrelationships among business and government and society and how these relationships evolve over time.

Master how to identify connections in global business between organizations as well as relationships and the environment.

Master how to describe how organizational politics and power as well as motivation and structure together with communication and human dynamics have an impact on how an organization functions.

Master how to analyze organizational culture from an international perspective.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Applied Leadership

Course description:

What you will learn:

Describe the role that leaders play in the success of the organization.

Master how to identify the differences between a leader and a manager.

Master how to compare and contrast concepts of leadership and management.

Master how to identify current challenges faced by leaders and managers.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Strategy and Organizational Planning

Course description:

What you will learn:

Examine the process of strategic analysis and planningas well as implementation and evaluation.

Master how to identify the different types of strategic planning tools and technique.

Master how to delineate the steps in the strategic planning process and the rationale for developing a strategic plan.

Master how to identify internal and external environmental factors key to effective strategy formulation and the constraints that impact strategy execution.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Statistics for Business Analytics

Course description:

What you will learn:

Identify the fundamental concepts of data/data types as well as variables and exploration.

Master how to prepare a sample of representative data from a population through the application of fundamental sampling principles and techniques.

Master how to analyze various hypothesis-testing scenarios.

Master how to apply probability theory to scenarios.

Course counts towards:

- MS in Data Analytics (MSDA)

Leadership and Organizational Development

Course description:

What you will learn:

Assess individual and group behavior in organizations and the influence on culture as well as motivation and performance.

Apply various leadership styles and conflict management strategies as well as change models to organizational situations.

Recommend appropriate organizational development interventions based on diagnostic evaluation of organizational issues.

Analyze organizational diagnostic approaches to determine opportunities for improvement and change.

Course counts towards:

- Master of Business Administration (MBA)

- Mini MBA Certificate

- MBA with specialization in Fintech & Blockchain

- MBA with specialization in AI

- MBA with specialization in Sustainability

- MBA with specialization in Enabling E-Commerce

- MBA with specialization in International Business

- MBA with specialization in Cybersecurity

Global Business

Course description:

What you will learn:

Analyze the role and interrelationships that culture and politics as well as economics and law and technology play within the context of a boundaryless environment and across multiple regions.

Master how to analyze the costs and benefits to home and host nations and government policy instruments used to influence foreign direct investment (FDI).

Master how to analyze the factors that determine currency exchange rates and the implications of change.

Master how to create a market entry strategy for a business operating in a global

local

or hybrid business environment.

Course counts towards:

- Master of Business Administration (MBA)

- Mini MBA Certificate

- MBA with specialization in Fintech & Blockchain

- MBA with specialization in AI

- MBA with specialization in Sustainability

- MBA with specialization in Enabling E-Commerce

- MBA with specialization in International Business

- MBA with specialization in Cybersecurity

Organizational Strategy

Course description:

What you will learn:

Apply appropriate strategic tools to complex business challenges.

Evaluate the strategic tools needed to create and sustain a competitive advantage.

Develop the appropriate management strategy based on the internal/external environment in which the organization operates.

Analyze the domestic and international market to determine how to shift strategy to respond to shifting market conditions.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Fintech & Blockchain

- MBA with specialization in AI

- MBA with specialization in Sustainability

- MBA with specialization in Enabling E-Commerce

- MBA with specialization in International Business

- MBA with specialization in Cybersecurity

Introduction to Intrapreneurship and Innovation

Course description:

What you will learn:

Analyze intrapreneurial strategies to drive innovation and positive change within an existing organizational context.

Assess the feasibility of internal opportunities identified for innovation for an organization.

Solve challenges in awareness and adoption and implementation of intrapreneurial projects.

Create a communication strategy that addresses relevant internal stakeholders for various innovations.

Course counts towards:

- Master of Business Administration (MBA)

- MS in Digital Transformation (MSDT)

- MBA with specialization in Fintech & Blockchain

- MBA with specialization in AI

- MBA with specialization in Sustainability

- MBA with specialization in Enabling E-Commerce

- MBA with specialization in International Business

- MBA with specialization in Cybersecurity

Corporate Sustainability

Course description:

What you will learn:

Evaluate corporate culture and social responsibility practices.

Examine how corporations that have made sustainability a core tenant of their strategy are making a significant impact on the environment independent of government regulation while driving strong financial results.

Formulate sustainable practices for the global environment that are informed by current issues.

Examine the exciting opportunities that sustainability challenges present for businesses/entrepreneurs and people engaged in this sector.

Course counts towards:

- Master of Business Administration (MBA)

- MS in Digital Transformation (MSDT)

- MS in Data Analytics (MSDA)

The Laws & Ethics of Information Technology

Course description:

What you will learn:

Analyze a selected company to identify the necessity for business change.

Master how to explore alternative approaches for a business that minimizes the impact of business changes on core structures.

Develop strategies to support employees through transitory times.

Master how to create a communication plan to inform key stakeholders about a business plan.

Course counts towards:

- MS in Data Analytics (MSDA)

- MS in AI and Technology Management (MSAI)

Professional Communication

Course description:

What you will learn:

Develop a strategic understanding of professional communication.

Course concepts to real-world business scenarios.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

- Career Pathway in Professional Sales

American Institutions and Culture

Course description:

What you will learn:

Describe the early history in forming the united states of america and its defining principles as well as values and structure.

Master how to explain how the U.S. evolved as a nation of immigrants and what different nationalities and ethnicities brought to the emerging nation over the course of American history.

Master how to identify current variations of the U.S. family and household.

Master how to examine U.S. labor and management.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

- Associate of Applied Science (AAS)

Intercultural Communication

Course description:

What you will learn:

Define major concepts and theories of intercultural communication.

Master how to differentiate between various communication processes unique to cultures and identify the barriers to intercultural communication.

Master how to analyze the roles of culture and language as well as power and communication on the development of personal and social and cultural identities throughout one's life.

Master how to analyze one's own cultural identity.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

- Associate of Applied Science (AAS)

Cultural Aesthetic Understanding

Course description:

What you will learn:

Describe the origins as well as varieties and meanings of the expressions and artifacts of human experience.

Master how to identify the modes of symbolic expression and aesthetic and/or literary conventions used in these expressions and artifacts.

Master how to reflect on one's own and other cultures and interpret or reinterpret artistic works through the development of skills of analysis and criticism.

Master how to explain the cultural and intellectual and historical contexts of expressions and artifact.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Doing Business in India

Course description:

What you will learn:

Analyze the cultural and socio-political canvas of India and its linkages at multiple levels with businesses.

Master how to analyze financial and business logistical nuances in the indian context as well as agents and institutions.

Master how to assess business opportunities within India inclusive of local regulation and available resources as well as infrastructure and culture.

Master how to explain the current business and economic landscape within India that impacts business and industry and workforce.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in International Business

Doing Business in China

Course description:

What you will learn:

Compare the most prominent and fastest growing industries within China to create a rationale for strategic public and private investments.

Master how to evaluate the key challenges and opportunities for doing business in China.

Master how to design a strategy for talent acquisition as well as retention and business development within China.

Master how to analyze the current business and economic landscape within China including the environmental differences that impact business and industry

and workforce.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in International Business

Doing Business in Sub-Saharan Africa

Course description:

What you will learn:

Compare the most prominent and fastest growing industries within Sub-Saharan Africa and to create a rationale for strategic public and private investments.

Master how to evaluate the key challenges and opportunities for doing business in Sub-Saharan Africa

master how to create a proposal to identify

manage

and plan for mitigating business risks unique to Sub-Saharan Africa.

Master how to analyze the current business and economic landscape within Sub-Saharan Africa including the environmental differences that impact business and industry and workforce.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in International Business

Cloud Computing

Course description:

What you will learn:

Apply a best-fit cloud computing architectural option and hosting model to a designated vertical industry.

Master how to develop a robust migration plan from legacy on-premise infrastructure to cloud computing based on technology economics and service introduction evaluation.

Master how to build a cloud computing offering which considers cybersecurity.

Master how to measure the cost reduction and revenue uptake resulting from the adoption of cloud computing architecture.

Digitizing Customer Experiences

Course description:

What you will learn:

Describe organizational functions within a customer facing unit.

Master how to apply emerging digital technologies related to customer experience.

Master how to evaluate the required people capability in developing a digitally-native customer facing organization.

Master how to apply different methods for flexible and dynamic research approaches for customer journey design.

Digitizing Supply Chain Management

Course description:

What you will learn:

Identify the value proposition of agility in supply chain management.

Master how to evaluate advanced digital transformation tools affecting the supply chain management functions.

Master how to measure the cost reduction and revenue uptake result due to digital transformation across the supply chain management functions.

Master how to develop a roadmap for digital transformation for supply chain management.

Digitizing Finance

Course description:

What you will learn:

Evaluate customer acquisition and retention engendered by digitization of financial services across the financial services sector.

Master how to evaluate the suitability of each digital financial service across emerging markets.

Master how to analyze the cost and revenue implications of digital transformation across various financial services; depending on each market maturity phase.

Master how to develop a roadmap for digital transformation in digital financial services appropriate to each market maturity phase.

Digitizing Product Management

Course description:

What you will learn:

Describe the customer journey touchpoints related to product development.

Master how to analyze the market trends and competitive landscape related to the future product roadmap.

Master how to identify key technology skills required for product management including big data analytics as well as mockup frameworks and partner ecosystems' application program interfaces (APIs).

Master how to develop a product portfolio business strategy including go-to-market direction and implementation performance management.

Fundamentals of Digital Transformation

Course description:

What you will learn:

Describe various modern digital strategy roles and the interrelationships of the roles within various organizational structures.

Master how to examine the alignment of the organizational mission and strategy with the digital strategy.

Master how to interpret principles of measuring as well as monitoring and developing a digital strategy based on a continuous and perennially improving analysis of information related threats and vulnerabilities and risks (both positive and negative).

Master how to identify people and tools and process capability digital transformation requirements.

Course counts towards:

- Bachelor of Business Administration (BBA)

Enabling E-commerce and Digital Strategy

Course description:

What you will learn:

Identify key concepts and components of e-commerce across various domains.

Evaluate the effectiveness of e-commerce infrastructure and security measures.

Describe how governments as well as NGOs and businesses leverage the internet for productivity and visibility.

Judge the significance of consumer dynamics and social marketing in the digital age.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Enabling E-Commerce

- MS in Digital Transformation (MSDT)

Policy and Regulatory Enablement of E-commerce

Course description:

What you will learn:

Assess the technological infrastructure required to facilitate e-commerce on national and global scales.

Master how to evaluate who the digital divide may most effect and what long range impacts on developing nations can result in such areas as education and national growth as well as competitiveness and higher value job creation.

Master how to compare and contrast national policies to assess the impact on innovation and competitiveness as well as new legislation and job creation in both developing and developed nations.

Master how to conduct a cost/benefit analysis of the global initiatives of regional governments to assess the benefits of e-commerce and digital capabilities for regional economies.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Enabling E-Commerce

Operations Digital Transformation

Course description:

What you will learn:

Assess digital transformation required capabilities in multiple verticals.

Master how to create a communication framework that mitigates risk within operations digital transformation projects.

Master how to measure the cost reduction and revenue uptake resulting from digital transformation across various verticals.

Master how to examine the utilization of intelligent process automation to drive process automation in the digital world.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Enabling E-Commerce

Principles of Macroeconomics

Course description:

What you will learn:

Explain the interrelationships between core macroeconomic terms and their impact on economies.

Master how to interpret data related to macroeconomic indicators to understand current economic trends.

Master how to analyze the potential effects of government spending on fiscal and monetary policies.

Use basic macroeconomic models to understand how demand and supply are affected within the economy.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

- Associate of Applied Science (AAS)

Principles of Microeconomics

Course description:

What you will learn:

Articulate key microeconomic concepts like scarcity and supply & demand as well as revenue & cost and profit.

Master how to apply microeconomic principles to real-world scenarios on market outcomes.

Master how to employ graphical tools and economic reasoning to analyze how supply & demand interact to determine equilibrium prices and quantities.

Master how to analyze the potential benefits and drawbacks of government interventions in the market.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

- Associate of Applied Science (AAS)

Introduction to Entrepreneurship

Course description:

What you will learn:

Identify the benefits and risks of starting a company especially within regional market conditions and opportunities.

Master how to determine viability of a business idea through conducting a competitive analysis.

Master how to evaluate which customer segments are most appropriate at various stages of development.

Master how to identify the role of a minimum viable product within lean startup and assess various techniques for executing effective prototypes.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Product and Marketing Skills for Founders

Course description:

What you will learn:

Determine the value and purpose of running a design sprint and how it can be used as a tool for brainstorming.

Master how to analyze opportunities where marketing and customer outreach prior to product development can be useful.

Master how to evaluate the difference between user experience and user interface design and the role each has in effective product design.

Master how to identify appropriate communication and language for branding and tone designed to help focus an offering from the customers' perspective.

Course counts towards:

- Bachelor of Business Administration (BBA)

Technical Skills for Non-Technical Founders

Course description:

What you will learn:

Recognize the business strengths and weaknesses of a range of common programming languages.

Master how to evaluate the uses and main providers of cloud services and the way they impact digital business models.

Master how to develop a plan that identifies technical business needs and core technical competencies in order to recruit and onboard technical talent.

Master how to distinguish among common categories of databases and how they are leveraged in a startup business setting.

Course counts towards:

- BBA with specialization in Entrepreneurship

- Bachelor of Business Administration (BBA)

Founders, Financing, and Legal

Course description:

What you will learn:

Determine the most critical components to a successful complementary cofounder team.

Identify the elements to successful co-founder collaboration and support.

Differentiate between the various types of financing paths and structures available to an early stage company.

Analyze the value of various legal structures to an early stage company.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

From Idea to Pitch

Course description:

What you will learn:

Identify and recall key concepts related to the entrepreneurial process such as business concepts and venture launch as well as inputs for business success.

Master how to explain the fundamental steps and processes involved in transitioning from a business idea to the successful launch of a new venture.

Master how to apply entrepreneurial concepts and principles to real-world scenarios.

Master how to analyze the various components and factors that contribute to the success of an entrepreneur including identifying potential challenges and opportunities in the entrepreneurial journey.

Course counts towards:

- MBA in Entrepreneurship (MBAE)

Startup Strategy and Development

Course description:

What you will learn:

Design a monetization strategy for your startup that aligns with the why and how of the startup.

Master how to develop a financial roadmap for your startup that covers financial and revenue/expense forecasting.

Justify the key metrics you will use to measure success in your startup.

Analyze business decisions for a start-up by providing a cost-benefit analysis.

Course counts towards:

- MBA in Entrepreneurship (MBAE)

Legal Topics for Founders: Navigating the Corporate Landscape

Course description:

What you will learn:

Differentiate between various legal entities and understand their implications for business operations.

Master how to apply knowledge of corporate/constitutional documents in the development of legal documents for the new business.

Master how to explain investor rights and terms/jargon and analyze their business impacts - emphasizing right of first refusal (ROFR) and anti-dilution.

Master how to evaluate the National Venture Capital Association (NVCA) standards focusing on subscription/stock purchase agreements and shareholder agreements and and Simple Agreements for Future Equity (SAFEs).

Course counts towards:

- MBA in Entrepreneurship (MBAE)

Fundamentals of Financial Management

Course description:

What you will learn:

Understand core financial management principles.

Analyze financial statements to assess business performance.

Manage working capital to optimize cash flow.

Leverage capital markets for strategic financial decisions.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Corporate Finance and Investment Analysis

Course description:

What you will learn:

Analyze how a company's balance sheet and income statement as well as statement of cash flows relate to each other.

Master how to evaluate simple and complex corporate financial structures and determine the optimal capital structure for a company.

Master how to analyze cash flows from operations and financing and investing.

Master how to calculate a corporation's cost of debt and cost of equity and weighted cost of capital within a given tax environment.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Corporate Tax Strategies

Course description:

What you will learn:

Describe fundamentals of tax law and tax rate structures for various corporate entities.

Master how to differentiate among economic and accounting and tax concepts of income.

Master how to determine current and future tax liabilities by analyzing financial transactions and calculating realized and recognized gains or losses.

Master how to classify deductions and losses and expenses for business and investment activities.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Financial Decision Making

Course description:

What you will learn:

Apply analytical tools and techniques to manage financial data and generate budgets/balance sheets/income statements and statements of cash flow as well as shareholders' equity or retained earnings and other comprehensive income.

Master how to measure financial risks and opportunities for international firms in order to inform decision-making.

Master how to explore the use of debt/equity (IPO

SEO) and alternative (ICO) financing options to raise capital and make investment decisions to increase the firm's value.

master how to determine the effects of corporate financial decisions on financial statements and ratios.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Fintech & Blockchain

- MBA with specialization in AI

- MBA with specialization in Sustainability

- MBA with specialization in Enabling E-Commerce

- MBA with specialization in International Business

- MBA with specialization in Cybersecurity

Funding for Startup Founders

Course description:

What you will learn:

Articulate the various funding options available for startups.

Identify potential investors or lenders for a startup business and effectively pitch a business concept to them.

Formulate a cohesive funding strategy for a startup business demonstrating the ability to prepare accurate financial projections.

Master how to deliver a persuasive pitch that demonstrates a clear understanding of the startup's value proposition and funding needs.

Course counts towards:

- MBA in Entrepreneurship (MBAE)

Financial Planning and Analysis

Course description:

What you will learn:

Analyze and interpret financial data for effective decision-making.

Master how to formulate strategic financial decisions in alignment with business goals.

Master how to assess investment and financing alternatives to optimize resource allocation.

Integrate diverse information sources for financial forecasting and planning.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Fintech & Blockchain

Blockchain for Finance

Course description:

What you will learn:

Explain the origins of blockchain and how blockchain technology works as well as the applications in finance and other industries.

Master how to identify use cases of various types of blockchain networks in the finance industry.

Master how to analyze blockchain technology's short- and long-term impact on the financial sector.

Master how to analyze the implementation of a financial blockchain network.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Fintech & Blockchain

Machine Learning Technology for Finance

Course description:

What you will learn:

Discuss the importance of financial data preprocessing and their impact on model performance.

Master how to apply appropriate machine learning techniques such as supervised and unsupervised and reinforcement learning to real-world financial problems.

Master how to assess the strengths and weaknesses of different machine learning algorithms in financial applications.

Master how to analyze the potential risks and challenges of using machine learning in finance including regulatory compliance and ethical considerations.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Fintech & Blockchain

- MS in AI and Technology Management (MSAI)

The Art of Communication

Course description:

What you will learn:

Examine the importance of the audience in communications.

Master how to analyze a range of corporate genres to determine how meaning is conveyed to a targeted audience.

Master how to integrate writing process knowledge with collaboration across stakeholders to implement leadership and operational communications.

Master how to produce unique and audience-driven organizational communications that leverage specific audience needs and clear appropriate communication styles.

Course counts towards:

- Master of Business Administration (MBA)

- MBA in Entrepreneurship (MBAE)

- MS in Digital Transformation (MSDT)

- MS in Data Analytics (MSDA)

Managing People Resources

Course description:

What you will learn:

Describe the strategic and operational roles of human resource management.

Master how to identify how the functions and roles of human resources are interconnected.

Master how to determine the expectations/motivators and drivers of success of the multigenerational workforce and the impact on HR strategy.

Master how to outline a plan for changes to an HR function or policy in an organization.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

Staffing and Development

Course description:

What you will learn:

Explain the processes and link between job analysis/staffing/total rewards/performance management/training/career development and continuous learning.

Master how to analyze the impact of staffing and training on management decisions and strategies for organizational growth.

Master how to determine the value and effectiveness of HR staffing and training initiatives using measures of efficiency and effectiveness and impact.

Master how to develop a recruitment and onboarding plan for a position at an organization.

Course counts towards:

- Bachelor of Business Administration (BBA)

Compensation & Benefits

Course description:

What you will learn:

Evaluate the different components of an organization's total reward system.

Master how to describe the legal environment which impacts the development of a compensation system.

Master how to create a total rewards plan for an organization.

Master how to explain how an organization collects and compiles data from various sources and the implications of a strategy of internal equity versus external (market) equity.

Course counts towards:

- Bachelor of Business Administration (BBA)

Strategic People Operations

Course description:

What you will learn:

Examine the interrelationship between HR strategy and organizational strategy.

Master how to evaluate the alignment between HR planning and strategic planning.

Master how to assess how organizations manage workforce changes and maintain a competitive advantage through HR strategies.

Master how to examine HR's role as a business partner to foster organizational intrapreneurship and change.

Course counts towards:

- Bachelor of Business Administration (BBA)

Building and Scaling an Organization

Course description:

What you will learn:

Analyze the critical needs of new businesses and identify the roles required to meet those needs.

Create an organizational chart based on the needs of a start-up business.

Identify tools and assessments to increase the efficiency of candidate screening and hiring.

Master how to identify the basics of an effective benefits package for employees.

Course counts towards:

- MBA in Entrepreneurship (MBAE)

Internet of Things

Course description:

What you will learn:

Evaluate IoT operating systems architectures and ecosystems.

Master how to apply best practices for IoT ecosystem while considering device management and cybersecurity.

Master how to develop a commercial value proposition utilizing edge analytics in IoT.

Master how to define IoT data services.

Course counts towards:

- Master of Business Administration (MBA)

- MS in Digital Transformation (MSDT)

- MBA with specialization in Cybersecurity

Cybersecurity Leadership

Course description:

What you will learn:

Compare and contrast concepts of cybersecurity leadership and ethical leadership and their roles in the modern organization.

Master how to assess continuously changing threats/vulnerabilities and positive and negative risks for a given business.

Master how to develop a plan for perpetually improving relations with all stakeholders of an organization including company policy and leadership and communications strategies.

Master how to analyze the unique characteristics of and connections between modern digital strategy roles and their roles in cybersecurity governance to better understand the role of security/ compliance audits and remediation.

Course counts towards:

- Master of Business Administration (MBA)

- MS in Digital Transformation (MSDT)

- MBA with specialization in AI

- MBA with specialization in Cybersecurity

- MS in AI and Technology Management (MSAI)

Product Management with Agile and Lean

Course description:

What you will learn:

Assess the role and competencies of a product manager in the organization.

Master how to define the product vision and feature set both at the outset of a project and within individual sprints.

Master how to examine the process of product management within an organization or team using agile XP and scrum.

Master how to develop solutions to the collection of bad data (e.g. poor use of statistics) or the reliance on vanity metrics and KPIs that are improperly defined or applied.

Course counts towards:

- Master of Business Administration (MBA)

- MS in Digital Transformation (MSDT)

- MBA with specialization in Cybersecurity

Marketing Fundamentals

Course description:

What you will learn:

Describe the role of marketing in advancing business and organizational objectives.

Master how to describe the cycle of consumer purchase behavior and the psychology behind decision making utilizing frameworks such as abcd: affects/backdrops/cognitions and demographics.

Master how to compare and contrast key marketing frameworks and the value in promoting various business objectives.

Master how to examine the issues of privacy/ethics/regulation and social responsibility as they relate to marketing functions.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in Digital Marketing

- BBA with specialization in AI

- BBA with specialization in Business Analytics

- Associate of Applied Science (AAS)

Digital Marketing Fundamentals

Course description:

What you will learn:

Identify how digital and technology trends are impacting the future of work and business.

Explain how to drive a customer through the stages of the path to purchase using different digital marketing channels.

Define the strengths/weaknesses/opportunities and threats (SWOT) of each digital marketing channel and their application to a business problem.

Develop a customer journey map with associated personas in the context of a new service or product.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Content Marketing and Social Media

Course description:

What you will learn:

Describe the components of key social media channels and their role in the customer journey.

Master how to analyze and develop a customer profile/demographic analysis in order to craft the appropriate message to reach the appropriate targeted demographic(s).

Master how to develop a social media strategy and playbook that includes paid/earned and owned media.

Master how to design campaigns that incorporate social media within customer relationship management (CRM).

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

- Career Pathway in Professional Sales

Branding and Creative Direction

Course description:

What you will learn:

Explain the definition of brand and its effects on consumers/shareholders/employees and third parties.

Master how to define the steps in creating a brand personality including identifying differentiators/initiating ideas via brainstorming tools and forming a mission and vision statement.

Master how to analyze the importance and legal means of protecting intellectual property and trademark rights on a regional/national and global scale.

Master how to evaluate how to measure campaign success and adapt and scale branding campaigns appropriately.

Marketing Strategy and Planning

Course description:

What you will learn:

Identify the components of a current state assessment for a product/service or experience offering including positioning/competitors and industry factors and trends.

Master how to analyze how various components of pricing strategy (e.g. profit margin/break-even/discounting/elasticity) work together to impact a marketing strategy.

Master how to develop channel and communication plans for broadly and narrowly defined target audiences.

Master how to define relevant marketing goals and select appropriate KPIs.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Digital Marketing

Marketing Channels, Tactics and Management

Course description:

What you will learn:

Distinguish between business-to-consumer and business-to-business marketing channels.

Master how to differentiate between above the line

below the line

and through the line marketing channels and the relative value and function of each.

Master how to evaluate the benefits and costs of various opportunities for sponsorship

product placement

and endorsements and propose effective ways to use these strategies for a variety of brands.

Master how to examine legal and ethical issues such as privacy

data usage

and regulatory laws and how they impact marketing strategy.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Digital Marketing

Digital Advertising and Search Engine Optimization

Course description:

What you will learn:

Describe the importance of data and a data-driven marketing strategy in a customer-oriented organization.

Master how to develop an organic search marketing strategy to bring high-quality traffic to a website.

Master how to design.

Set up and optimize ad campaigns across platforms.

Master how to analyze the role and use of different performance marketing channels in a marketing mix.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Digital Marketing

- BBA with specialization in Entrepreneurship

Digital Marketing Analytics

Course description:

What you will learn:

Describe the operational benefits of digital analytics and a data-driven organization.

Evaluate different attribution models for their strengths and weaknesses.

Analyze data sets and provide actionable recommendations.

Identify key metrics used for the measurement and analysis of digital marketing activity.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Digital Marketing

Marketing Strategy

Course description:

What you will learn:

Valuate the importance of customer insights and consumer behavior on marketing strategy and successful brand development.

Examine the role that messaging has in connecting with customers and how targeted communication is critical in today's marketplace.

Master how to compare and contrast a local-only marketing strategy with a global approach.

Master how to examine the role of transformative technologies that impact global marketing strategy.

Course counts towards:

- Master of Business Administration (MBA)

- MBA in Entrepreneurship (MBAE)

- Mini MBA Certificate

- MBA with specialization in Fintech & Blockchain

- MBA with specialization in AI

- MBA with specialization in Sustainability

- MBA with specialization in Enabling E-Commerce

- MBA with specialization in International Business

- MBA with specialization in Cybersecurity

- MS in AI and Technology Management (MSAI)

Product Go-to-Market

Course description:

What you will learn:

Analyze market needs using relevant market research techniques.

Relate customer segmentation to its role in effective product launch strategies for successful market entry.

Perform market sizing to understand potential opportunities and risks.

Master how to apply product positioning strategies that differentiate the product in the market.

Course counts towards:

- MBA in Entrepreneurship (MBAE)

Nutrition and Wellness

Course description:

What you will learn:

Identify the nutrients needed by humans for healthy living.

Master how to examine the dietary sources of nutrients and their benefits to the metabolism.

Master how to create a personal physical fitness plan and self-responsibility checklist.

Master how to develop strategies to minimize adverse effects on nutrition and wellness.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

- Associate of Applied Science (AAS)

Technology & Operations Management

Course description:

What you will learn:

Assess the technology architecture and infrastructure capabilities depending on various operating models.

Master how to evaluate how technology-savvy human capital drives technology adoption in operations management.

Master how to assess the value proposition of integration technology across operating functions including cost reduction and revenue generation.

Master how to create a value-based operational strategy.

Course counts towards:

- MS in Digital Transformation (MSDT)

- Master of Business Administration (MBA)

- MBA with specialization in Fintech & Blockchain

- MBA with specialization in AI

- MBA with specialization in Sustainability

- MBA with specialization in Enabling E-Commerce

- MBA with specialization in International Business

- MBA with specialization in Cybersecurity

- MS in AI and Technology Management (MSAI)

Problem Solving & Critical Thinking

Course description:

What you will learn:

Explain the central elements of problem solving and decision making.

Master how to develop a strategic approach to individual growth and development and organizational performance.

Master how to identify the human factors that impact the results in problem solving and decision making processes.

Master how to apply problem solving and decision making processes and methods to real-world situations.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Introduction to Agile Product Management

Course description:

What you will learn:

Identify the role of a product manager within the overall organization.

Master how to describe the techniques that product managers use to effectively lead a team.

Master how to determine feature prioritization and how to organize a team.

Master how to identify how to react to unexpected change and guide the team.

Software Skills for Digital Product Managers

Course description:

What you will learn:

Identify basic programming skills and concepts.

Master how to apply knowledge of databases and SQL to answer basic business questions.

Master how to describe basic web

mobile

and cloud technology stacks.

Master how to analyze the role of technical debt and how it impacts feature prioritization and feature build times.

Product Design Skills for Product Managers

Course description:

What you will learn:

Differentiate between the user experience (UX) and the user interface (UI).

master how to conduct a user interview and pinpoint issues.

Master how to describe a user persona and how to create one.

Master how to analyze the purpose of wireframes and how visual ideas impact form and function.

Agile Leadership

Course description:

What you will learn:

Identify logical fallacies used in the workplace and how to use appropriate communication techniques to influence others.

Utilize communication skills to share information effectively.

Demonstrate conflict resolution techniques.

Identify trends and areas requiring attention based on KPI data.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Achieving Product-Market Fit

Course description:

What you will learn:

Identify customer problems using lean and agile product strategy approaches.

Master how to apply design processes to validate product ideas and ensure product-market fit.

Master how to refine product ideas to align with the needs and expectations of the target customer.

Master how to implement a vision for a product that is poised for long-term success in the market.

Course counts towards:

- MBA in Entrepreneurship (MBAE)

Executing a Vision: Product Design & Development for Entrepreneurs

Course description:

What you will learn:

Apply the principles of design thinking to bridge the gap between abstract ideas and sellable products.

Master how to analyze a case study on user-generated idea generation for idea validation.

Master how to create and utilize personas and story maps as part of the design thinking process to enhance user experience.

Master how to develop prototypes as a tangible representation of ideas.

Course counts towards:

- MBA in Entrepreneurship (MBAE)

- MS in AI and Technology Management (MSAI)

Project Management

Course description:

What you will learn:

Differentiate between the user experience (UX) and the user interface (UI).

Master how to conduct a user interview and pinpoint issues.

Master how to describe a user persona

why we need them

and how to create one.

Master how to analyze the purpose of wireframes and how visual ideas impact form and function.

Course counts towards:

- Bachelor of Business Administration (BBA)

Science of Happiness

Course description:

What you will learn:

Identify key theories of positive psychology.

Master how to analyze strategies for leading change in cross-culturally complex situations.

Master how to create a plan outlining strategy that will make the workplace or home environment happier.

Master how to reflect on the importance of setting goals and taking accountability for living a happier life.

Course counts towards:

- Associate of Applied Science (AAS)

- Bachelor of Business Administration (BBA)

Environmental Science

Course description:

What you will learn:

Identify sources and examples of environmental agents.

Master how to employ the processes of risk management and risk assessment to evaluate environmental risks.

Master how to identify emerging environmental health issues and formulate possible solutions.

Master how to identify specific practical measures one can apply at an individual and organizational level to become more environmentally responsible.

Course counts towards:

- Bachelor of Business Administration (BBA)

Introduction to Supply Chain Management

Course description:

What you will learn:

Determine the differences between a traditional versus a non-traditional supply chain.

Master how to describe the value proposition of agility in the supply chain.

Master how to identify the importance of the advanced digital transformation tools affecting the supply chain management function.

Master how to develop a digital transformation roadmap for supply chain based on the organization's value proposition.

Course counts towards:

- Bachelor of Business Administration (BBA)

- BBA with specialization in Entrepreneurship

- BBA with specialization in AI

- BBA with specialization in Digital Marketing

- BBA with specialization in Business Analytics

Impact of E-commerce on the Supply Chain

Course description:

What you will learn:

Evaluate best practices for e-commerce facilitation.

Master how to examine supply chain practices and principles connected to e-commerce.

Master how to determine the skills and competencies required by the professional workforce participating in e-commerce activities.

Master how to analyze the principles and practices of e-commerce management as they relate to the supply chain.

Integrated Supply Chain Management and Sustainable Operations

Course description:

What you will learn:

Analyze sustainable operations within an integrated supply chain process.

Master how to describe the triple bottom line as it relates to the supply chain.

Master how to examine effective managerial approaches to the integrated supply chain process and the triple bottom line.

Master how to evaluate the implications of operational decisions that support the global long-term sustainability of the organization.

Statistics

Course description:

What you will learn:

Apply the fundamental logic of hypothesis testing used to interpret data.

Master how to identify various sampling methods used in scientific research.

Master how to explain positive and negative and skewed correlations.

Master how to formulate graphs and charts from statistical data.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

- Career Pathway in Operations Management

Food and Agribusiness

Course description:

What you will learn:

Examine the root causes of current food and agribusiness issues with specific focus on how these issues will impact our societies and environment in the future.

Master how to apply appropriate quantitative and analytical techniques to create a proposal tailored to the target audience.

Master how to apply knowledge of food and agribusiness practices through the evaluation of market opportunities to develop an agribusiness plan.

Master how to evaluate quantitative and analytical techniques appropriate for assessing emerging food and agribusiness challenges and technologies.

Course counts towards:

- MBA with specialization in Sustainability

- Master of Business Administration (MBA)

Renewable Energy

Course description:

What you will learn:

Examine the terminology and concepts and technical and economic components of viable and emerging renewable energy technologies including energy avoidance practices.

Master how to apply appropriate interdisciplinary collaborations to optimize economic and technical applications of renewable energy for a given business use or purpose.

Master how to develop a renewable energy strategy which aligns with corporate social responsibility policies.

Master how to evaluate renewable/avoidant energy options within the entire business value continuum from product and service innovation to consumer use.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Sustainability

Managing Healthcare

Course description:

What you will learn:

Examine a health organization's ability to offer technology-based solutions to inform a plan for community-based wellness using analytical techniques and mind mapping.

Master how to forecast the influence of reimbursement and payment systems when assessing alternatives for performance improvement.

Master how to evaluate the value of leadership coaching to healthcare and for its impact on the performance and retention of high-quality talent.

Master how to develop a plan for addressing future health and wellness programs that recognize ethnic and cultural differences and challenges with current and future technology initiatives and healthcare occupational shortages.

Course counts towards:

- Master of Business Administration (MBA)

- MBA with specialization in Sustainability

Introduction to Spreadsheets and Modeling

Course description:

What you will learn:

Identify and compare popular spreadsheet applications including customization options.

Master how to employ effective techniques for accurate and clear data entry and formatting including cell referencing and data validation.

Master how to apply basic mathematical and logical functions to both perform calculations and automate decision-making.

Master how to create compelling charts and graphs to visually represent and communicate your data analysis.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Associate of Applied Science (AAS)

- Career Pathway in Operations Management

- Career Pathway in Professional Sales

Decoding the Digital Consumer

Course description:

What you will learn:

Explain the fundamental concepts of consumer psychology and their relevance to sales/marketing and product design.

Analyze the impact of technology on consumer behaviour and the role of mobile devices in the purchase journey.

Apply persuasion techniques and principles of influence to craft compelling sales messages and presentations.

Evaluate how choice architecture and framing effects and heuristics impact consumer decision-making in tech-enabled sales environments.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Career Pathway in Professional Sales

Professional Selling and Relationship Management

Course description:

What you will learn:

Identify customer buying behaviors and decision-making processes.

Apply prospecting techniques to generate leads and qualify customers.

Develop effective sales pitches tailored to customer needs.

Implement strategies for building rapport and trust with clients.

Course counts towards:

- Bachelor of Business Administration (BBA)

- Career Pathway in Professional Sales

Digital Selling and E-commerce Strategies

Course description:

What you will learn:

Describe various modern digital strategy roles and the interrelationships of the roles within various organizational structures.

Master how to examine the alignment of the organizational mission and strategy with the digital strategy.